New York State Shared Work Program – Frequently Asked Questions for Furloughed Employees

The following questions and answers address many of the questions you may have regarding ABC Co’s furlough and the New York State Shared Work Program. To view each set of questions and answers you can either click one of the links below or click on the navigation arrows on the right. If you have any questions that are not addressed here, please send them to ABCCoHR@abcco.com.

New York State Shared Work Program

New York State Shared Work Program

If I fail to certify my Shared Work claim online by the weekly deadline, will I still receive my payment?

If you fail to certify online in time, you will not be paid. If you miss the cutoff, you must file by paper with Corning, which will delay your payment. Click here for a copy of the form. You will need to email the completed form to ABCCo@ABCCo.com

How do I certify my state Unemployment Insurance benefits once I have filed a claim?

Here’s how to certify your claim:

- Go to: https://dol.ny.gov.

- Hover over “Manage Your Workforce.”

- Scroll down to “Shared Work Program” and click on it.

- Scroll down until you see a blue area. Once you see “Employees,” click on the button that says “File a Claim.”

- Scroll down and click on the link for “Online Services for Individuals.”

- Once there, you can either log on if you already have an account, or you can sign up for an account and file your claim.

What if I believe my Shared Work weekly benefit amount is incorrect?

After filing your Shared Work claim, an initial Monetary Determination (form LO 403) will be mailed to you, showing your work and wages over the past 18 months that were used to calculate your benefit rate. If you believe that the form is incorrect or needs to be recalculated, you can contact the ABC Co Unemployment Assistance Helpline at 888-123-4567 from 8:30 am to 5:00 pm ET, Monday-Friday.

The total New York Unemployment Insurance benefit that is reflected online is $504. Why is that amount less than what I expected to receive?

Your ABC Co Compensation statement included both the New York Shared Work Program benefit and the CARES Supplement. This will not be reflected online until your first payment. The New York Shared Work Program confirmed that $504 is the amount of the Unemployment Insurance benefit you would have received had you been totally unemployed. This amount will not change on the website portal. However, your payment history will be updated with the reduced percentage amount you’ll receive on the Shared Work Program.

If someone is asking for verification of my employment status (i.e., furlough/layoff), who do they call?

ABC Co outsources all employment verifications to Equifax. Contact The Work Number directly at www.theworknumber.com or 800-367-1234.

I have received an email from the New York Department of Labor asking for “back dated” weeks of unemployment verification. What do I need to do?

As an ABC Co employee receiving unemployment under the New York Shared Work Program, you can disregard the email requesting back dated unemployment verification for the weeks you were participating in the Shared Work Program. If you were previously on regular unemployment, you can complete it for any back weeks you did not receive your benefits while on regular unemployment.

Why am I being asked to update my state Unemployment Insurance benefit claim between Wednesday and Saturday of each week? I thought I could update my claim beginning Monday of each week?

The state Unemployment Insurance system is displaying this message because of high claim volumes typically received on Mondays and Tuesdays. You can still update your claim for benefits on Mondays.

What web browser works best for when I’m setting up my NY.gov account?

The following web browsers are compatible with the NY.gov application:

- Microsoft Internet Explorer 11 (on Windows 7)

- Microsoft Edge

- Mozilla Firefox 27

- Google Chrome 30

- Opera

- Apple Safari 7

Other browsers may have compatibility issues.

What happens if I miss the deadline to register for unemployment?

If you fail to register for unemployment by the deadline, you must complete this paper form and email it to Corning at ABCCo@ABCCo.com so we can certify your information and forward the form to the New York State Department of Labor. Not completing the form by the deadline will delay your payment.

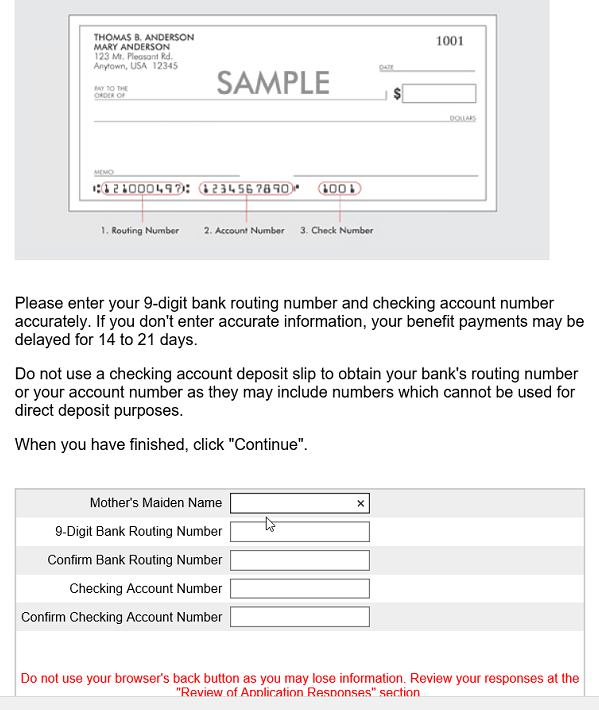

How are Shared Work benefits or payments issued?

You will have a choice how to receive your Shared Work benefit payment. The fastest way to receive your payment is to have your benefit payment electronically transferred into your checking/savings account if your bank has a direct deposit program. When you are filing your claim for benefits, follow the instructions for initiating direct deposit for your benefit payment (Step 9 of the process). If you do not choose to use direct deposit, payments may be issued through a debit card.

Is everyone required to take the same day off? Can I work seven hours a day instead of eight?

Everyone is not required to work the exact same schedule during ABC Co's NY-SWP. ABC Co recommends you take your furlough in full-day increments and work with your supervisor to determine what schedule makes sense in light of business needs. We recognize and expect that schedules may need to be adjusted or be flexed from time to time as business needs change. However, you are still subject to the reduced hour caps.

Will working a second, part-time job affect my benefit rate?

Yes. Any work with a different employer or self-employment will reduce the amount of Shared Work benefits that you may receive each week. As with regular unemployment, for each day that you work in a week, you lose one-quarter of your Shared Work benefits. For example, if you normally receive $80 in Shared Work benefits and you work two days in a week, your benefit amount would be reduced by half to $40.

If I normally work overtime, can I receive Shared Work benefits for a reduction in my overtime hours?

No. Shared Work benefits can only be paid to compensate for wages lost because of a reduction in your normal work schedule of no more than 40 hours per week.

Who should I contact if I have a question about my Shared Work benefits or if I have not received my benefit payments?

You should contact the ABC Co Unemployment Assistance Helpline at 888-374-8730 from 8:30 am to 5:00 pm ET, Monday-Friday.

I work in NY State, but live in Pennsylvania. Am I eligible to file for NY State Unemployment?

Yes. Employees who pay NY State Unemployment taxes are able to receive NY State Unemployment benefits. As a rule, you file for unemployment benefits in the state in which you work, not the state in which you live.

Where can I find information on the New York Shared Work Program website about the extra $600 CARES Act payment I should be receiving each week?

The extra $600 payment will be shown when it is paid to you. It is not shown on the main Shared Work Program information screen (that includes your benefit rate).

Can I apply for unemployment to cover the reduced work/pay?

You MUST file for New York State unemployment compensation in order to receive the combination of the New York State Unemployment and CARES Act Pandemic Unemployment Compensation for your furlough days. See the New York State Shared Work Program section of this Resource Center for detailed instructions on how to enroll.

I normally work in excess of 50 hours a week. Are you mandating that I work only 32 hours a week now? What if I’m under a deadline?

Under the NY Shared Work Program requirements you will be subject to an hours “cap” depending on your furlough (1 day = 32 hours cap; 2 days = 24 hours cap; 3 days = 16 hours cap). You are not permitted to work more than the hours cap during the furlough weeks. However, you may flex your schedule and days off within the week to accommodate business needs that might arise.

What are the expectations on my unpaid day(s)? Will my manager expect me to be available for calls or deliverables?

You are not expected to work on your furlough day(s).

What if I am asked to work more than the hours cap?

Speak to your supervisor or human resources manager.

What furlough options are available under the ABC Co NY-SWP? What should I tell my customers if they can’t reach me?

Each unit will need to manage its day-to-day operations uninterrupted to the extent possible. Please discuss any customer-related issues with your manager so that you have proper coverage for your customers.

What is Shared Work?

Shared Work is a program that allows you to collect partial unemployment benefits if your hours and wages have been reduced by 20% to 60%, AND your employer has been approved by the Department of Labor to participate in this program. Under the Shared Work Program, the weekly amount of unemployment benefits you receive is connected to the percentage your hours and wages have been reduced. For instance, if your work hours and wages have been reduced by 20% on a given week, you may receive 20% of your unemployment weekly benefit rate.

What are the Shared Work Plan requirements?

To be able to participate in the Shared Work Program, your employer has agreed:

- To reduce the hours and wages of all or a particular group of employees by no less than 20% and no more than 60%.

- To include in the Shared Work Plan only workers who normally work no more than 40 hours per week. Not to reduce or eliminate fringe benefits, including health, medical insurance, and retirement, provided prior to the start of the Shared Work Plan unless the fringe benefits of the entire workforce are reduced or eliminated. That the plan cannot exceed 53 weeks.

- Not to hire additional employees for the work group that is covered by the Shared Work Plan.

- That the Shared Work Plan must be approved by a collective bargaining agent, if there is one.

- That the Shared Work Plan must be in lieu of a layoff for an equivalent percentage of employees.

- That all employees in an affected unit must be included in the program and reduced to the same extent during each week of the plan. The percentage of reduction may vary from unit to unit or week to week as long as it remains between 20% and 60%.

- If you feel that your employer has not honored these requirements, please contact the Department of Labor – Liability and Determination Section at 518-457-5807.

What are your eligibility requirements?

If you are on the approved Shared Work Plan, you must meet the same basic eligibility requirements that apply to regular unemployment insurance benefits, except that you only need to be available to work for the Shared Work employer; i.e., you are not required to look for other work.

Any work with a different employer or self-employment will reduce the amount of Shared Work benefits for which you are eligible.

You are not eligible for Shared Work benefits in any week in which you receive supplemental unemployment compensation benefits (SUB pay).

You may receive a maximum of 26 weeks of regular Shared Work benefits, plus any federal extended benefits you may qualify for during your benefit year. You may not receive more in a benefit year from Shared Work benefits combined with regular UI benefits than you would receive under the regular UI program alone (26 times regular benefit rate).

You must physically work at least one day with your Shared Work employer in order to be eligible for Shared Work benefits in a particular week.

© 2020 ABC Co All Rights Reserved.